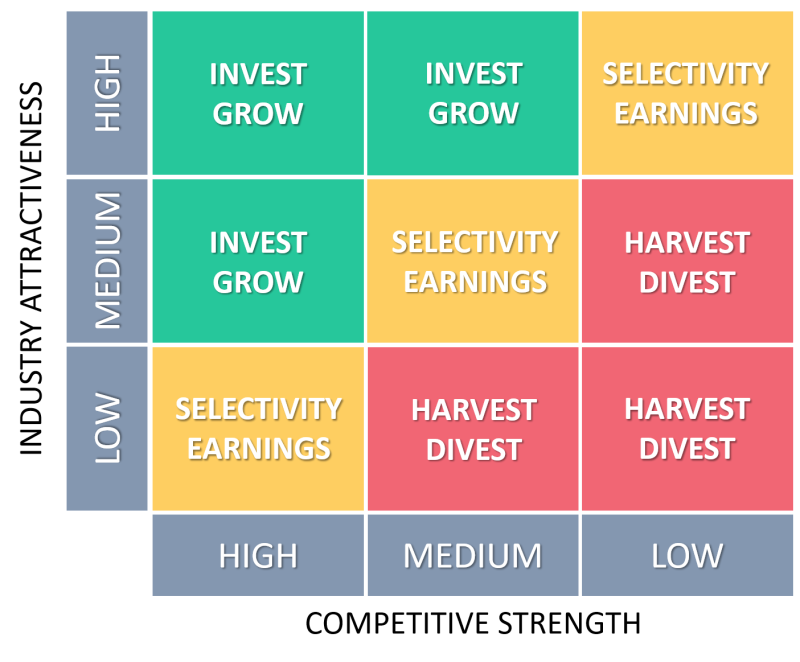

This matrix combines two dimensions: industry attractiveness and the competitive strength of a business unit into a matrix. Correspondingly, a business can direct its business units. It can then determine where to invest, to hold their position, harvest or divest.

Origins

In 1970, General Electric (GE) engaged McKinsey & Company to consult GE in managing its large and complex portfolio of strategic business units. McKinsey (not GE) created this framework to help GE cope with its strategic decisions on a corporate level.

GE-McKinsey Matrix

Unlike the BCG MatrixThe BCG Matrix has been criticized a lot on its use of only one single dimension for analysis., the GE-McKinsey Matrix uses multiple variables to determine the two dimensions:

Industry Attractiveness

This factor refers to the ease with which the business unit will be able to accrue profit in the industry. When evaluating the business along this dimension, consider the long term growth potential, industry size, industry profitability, entry and exit barriers, etc. Furthermore, evaluate the power of suppliers and buyers as well as any other environmental factors that could influence industry attractiveness.

In addition, consider your product or service, how they change over time, pricing and labor requirements. It is important to consider all these dimensions, focusing on the distant future. This is because investments require a long-term, rather than a short-term, commitment.

The vertical axis of this matrix – Industry Attractiveness – is divided into High, Medium and Low. Industry attractiveness represents the profit potential of the industry for a business to enter and compete in that industry. The higher the profit potential, the more attractive is the industry. An industry’s profitability is affected by the current level of competition and future changes in the competitive landscape. When evaluating industry attractiveness, evaluate how an industry will change in the long run rather than in the short-term.

Competitive Strength

When evaluating a business unit along this dimension, consider how it fares relative to its competitors within the industry. Some factors that can help a business assess its competitive advantage in an industry are:

- Market share it commands

- Market share growth potential

- Brand awareness

- Profit margins of the business

- Customer loyalty and satisfaction

- Uniqueness of its products or services

If the business has a competitive edge, consider whether its competitiveness is sustainable in the long-term or only temporary. Finally, if the business has a sustainable competitive advantage, determine the duration that it can leverage its position in the industry.

The horizontal of this matrix – Competitive Strength – is divided into High, Medium and Low. This dimension measures the business’s competitiveness among its rivals. This dimension indicates the business’s ability to compete in that industry. A business’s strengths give it an advantage over its rivals.

These strengths are often referred to as unique selling points (USP’s), firm-specific advantages (FSA’s) or as sustainable competitive advantages.

In addition to a business’s competitive position today, it’s important to look its sustained competitiveness in the long run.

Strategic implications

The three degrees (High, Medium and Low) of Industry Attractiveness and Competitive Strength provide 9 different strategic postures for a business. The strategic actions to choose from are:

- Invest / Grow strategy

- Selectivity / Earnings strategy, and

- Harvest/Divest strategy

Invest/Grow strategy

The best position for a business to be in is the Invest/Grow section. A business can reach this scenario if it is operating in a moderate to highly attractive industry while having a moderate to highly competitive position within that industry. In such a situation, there is a massive growth potential.

However, to grow, a business needs resources, such as assets and capital. These investments are necessary to increase capacity, reach new customers through marketing or improve products through Research & Development. A business can also choose to grow externally via Mergers & Acquisitions (M&A), in addition to organic growth. Again, it will require investments to execute M&A activities.

The most notable challenges for a business in these sections are resource constraints that block it from growing bigger and becoming / maintaining market leadership.

Selectivity/Earnings strategy

This strategy is also referred to as Hold strategy. A business in the selectivity / earnings section is a bit more tricky. The business is either in a low – moderate competitive position in an attractive industry or in an extremely high competitve position in a less attractive industry. Deciding whether to invest or not to invest largely depends on the business’s outlook. It could expect to, either improve its competitive position or shift to a more attractive industry.

The business should carefully decide its competitive move. As a business, you want to use most of your investments in the Invest/Grow section. Then, use the remaining investments in the selectivity / earnings section to improve your competitive position. You should closely monitor the progress and improvements and correct course as necessary.

Harvest/Divest strategy

This strategy is most appropriate for a business that:

- has a low competitive position

- is active in an unattractive industry, or

- a combination of the two

These businesses do not have too many promising outlooks. The strategic responses to consider are:

- Divest the business units by selling it to an interested buyer for a reasonable price. This also known as a carve-out, or

- Choose a harvest strategy

Selling the business unit to another player in the industry that has a better competitive position is not a strange idea at all. The buyer might have better competences to make it a success. Or, the buyer can create value by combining activities i.e. leverage synergies. The business can use the cash it results from divestment in Invest/Grow section elsewhere in its portfolio.

Harvesting means that the business unit gets just enough investments to keep it operational. In other words, the business cashes whatever is left. This is a very short-term perspective that allows a business to subtract as much remaining cash as possible. However, such businesses are eventually liquidated and exit the industry.