External Factor Evaluation (EFE) Matrix is a strategic analysis tool used to evaluate firm’s external environment and to reveal its strengths as well as weaknesses. The external and internal factor analyses have been introduced by Fred R. David in his book, Strategic Management[1]. According to the author, both tools are used to summarise the information gained from company’s external and internal environment analyses.

External Factor Analysis

Key External Factors

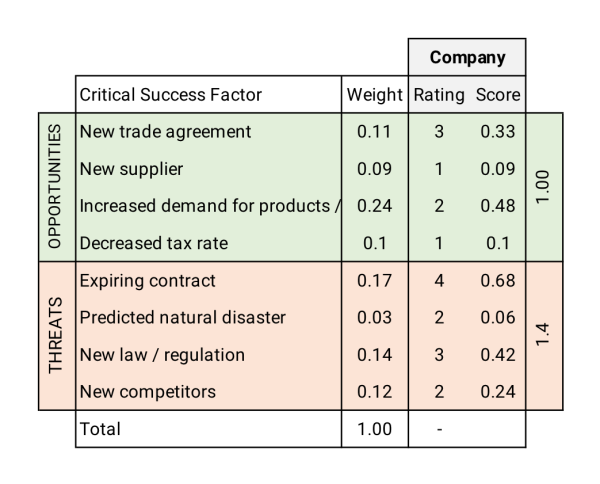

When using the EFE matrix we identify the key external opportunities and threats that are affecting or might affect a company. By analysing the external environment with the tools like PESTLE analysis, Porter’s Five Forces or Profile Matrix, the key external factors can be identified. The general rule is to identify as many key external and internal factors as possible.

Weights

Each key factor should be assigned a weight ranging from 0.0 (low importance) to 1.0 (high importance). The number indicates how important the factor is if a company wants to succeed in an industry. If there were no weights assigned, all the factors would be equally important, which is an impossible scenario in the real world. The sum of all the weights must equal 1.0. Separate factors should not be given too much emphasis (assigning a weight of 0.30 or more) because the success in an industry is rarely determined by one or few factors.

Ratings

The ratings in external matrix refer to how effectively company’s current strategy responds to the opportunities and threats. The numbers range from 4 to 1, where 4 means a superior response, 3 – above average response, 2 – average response and 1 – poor response. Ratings, as well as weights, are assigned subjectively to each factor. In our example, we can see that the company’s response to the opportunities is rather poor, because only one opportunity has received a rating of 3, while the rest have received the rating of 1. The company is better prepared to meet the threats, especially the first threat.

Weighted Score

The score is the result of weight multiplied by rating. Each key factor must receive a score. Total weighted score is simply the sum of all individual weighted scores. The firm can receive the same total score from 1 to 4 in both matrices. The total score of 2.5 is an average score. In external evaluation a low total score indicates that company’s strategies aren’t well designed to meet the opportunities and defend against threats. In internal evaluation a low score indicates that the company is weak against its competitors.

Note that EFE analyses only help identify and evaluate the factors, but do not directly help formulate a strategy or the next best strategic move.

References

| ↑1 | David, F.R. (2009). Strategic Management: Concepts and Cases. 12th ed. FT Prentice Hall |

|---|