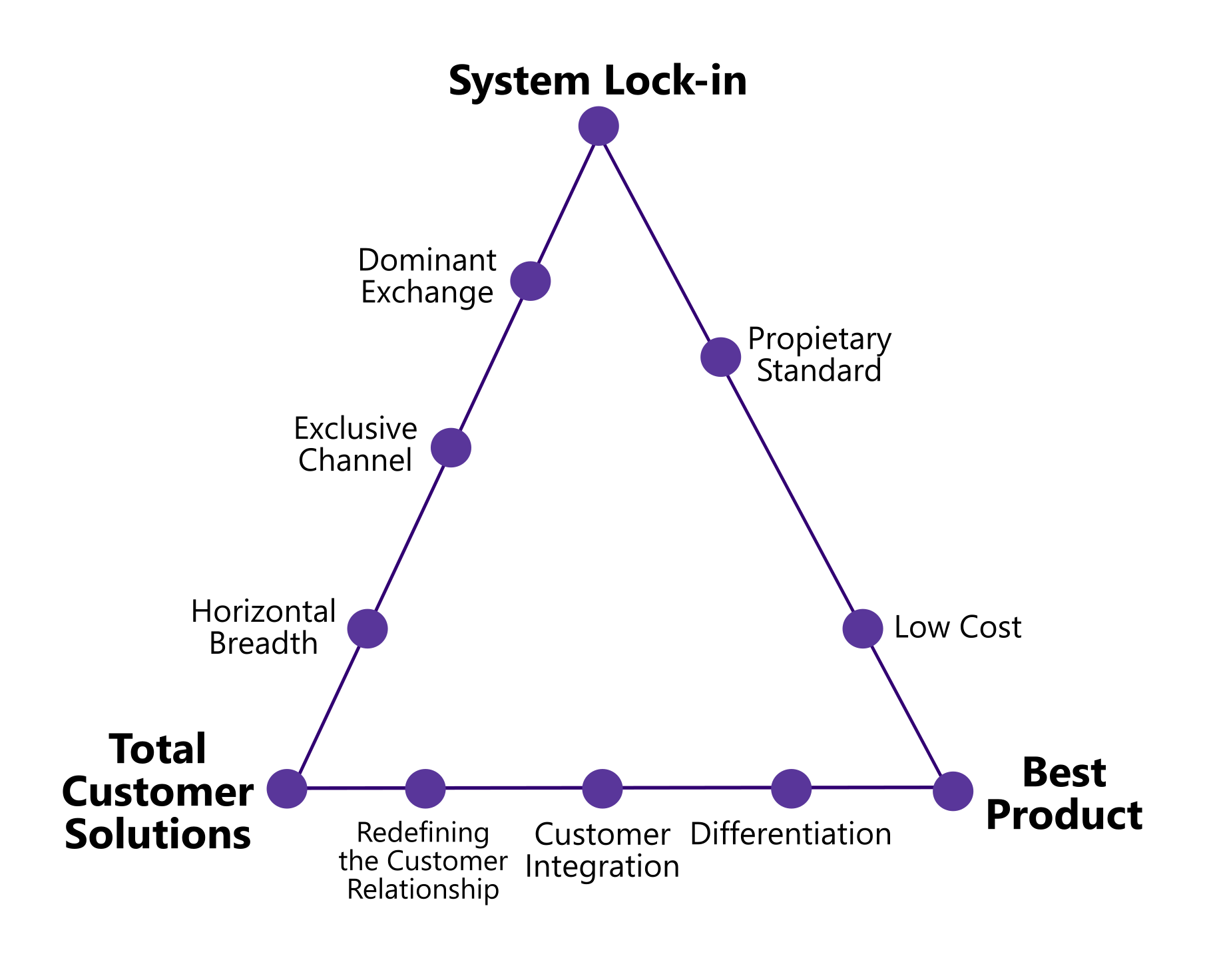

Hax’s Delta Model is a strategy framework that puts the customer at the heart of management. It looks at the main ways to build bonds with customers and guides strategy and execution by aligning adaptive processes. The Triangle diagram illustrates three different ways to implement the strategies of the Delta Model. The three strategic approaches are:

- System lock-in

- Total customer solutions

- Best product positioning

The emergence of the Internet significantly increased communication possibilities that were previously unavailable. This paradigm spurred technologies related to e-business and e-commerce. Consequently, powerful new tools that were previously inaccessible enabled the viability of whole new business models.

Hax Delta Model

The Delta Model is an integrated strategy formulation process that gives a fresh perspective on strategic management in response to such emerging contexts. As a result, a new set of strategic positioning alternatives that are based on the idea of customer bonding are required. These possibilities extend beyond a product-centric vision and focus on generating lasting competitive advantage.

According to Hector Ruiz, Chairman of the Board, Global Foundries, Inc., and former Chairman, Advanced Micro Devices:

The Delta Model is a powerful tool for any business that is at any stage of institutional development. Regardless of whether it is a brand new company or business unit, or an established business with a need for revamping or fine tuning their business model, the Delta Model is the one tool I have found to be overwhelmingly appropriate in a very systematic and effective way, to accomplish the task. When the management team of an organization approaches strategy development and implementation through the use of the Delta Model, the inescapable result is a cohesive set of outputs that bind the enterprise together in a well understood set of powerful statements as to what the corporation is, its purpose, and the overriding strategic actions plans that will insure that the mission and vision of the institution is accomplished.

Both, for-profit and non-profit sectors could benefit from the Delta model. According to Hansjoerg Wyss, Chairman and CEO Synthes Inc, The Wyss Foundation, The Southern Utah Wilderness Alliance and the Beyeler Art Museum Foundation:

The Delta Model gives leaders of any organization, huge or small, the opportunity to change from being managers to becoming internal consultants able to develop a viable strategy, encompassing the inside and outside worlds. We have used the Delta Model in nonprofit and for profit organizations and found its focus on the customer and what the organization can bring to fulfill the customers’ needs extremely helpful. The internal group developing the strategy has to implement it, which makes the Delta Model very practical and valuable. I have tested many strategic models and found the Delta Approach the most useful one.

Origin

The Delta Model was developed by Dean & Company co-founder Dean Wilde, and Arnoldo Hax of the MIT Sloan School of Management to help managers formulate and implement effective corporate and business strategies. It grew from a conviction that the world of business had been experiencing transformations of such magnitude that existing managerial frameworks were either invalid or incomplete.

Despite the great proliferation of managerial frameworks in the business strategy literature, two key paradigms emerged in the past decades:

- Competitive positioning as put out by Michael Porter of the Harvard Business School in the 1980s, and

- The resource-based view of the company that evolved in the 1990s

In economic terms, a successful corporation is one that appropriates monopoly rents. In other words, the business becomes the dominant (or single) rival in the industry as a whole or in a section of the industry.

This viewpoint led Porter to the inevitable conclusion that there are only two ways to compete, either through:

- Cost Leadership, or

- Product Differentiation

Cost Leadership

Porter’s taxonomy became recognisable to most managers in the 1980s. Cost leadership is accomplished by aggressively pursuing economies of scale, product and process simplicity, and considerable product market share, which enables organisations to capitalise on experience and learning effects.

Differentiation

Differentiation entails developing a product that the buyer considers as extremely valued and one-of-a-kind. Differentiation strategies may take various forms, such as brand image design, technology, features, customer service, and dealer networks.

The Delta Model

Hax, on the other hand, created a new strategy framework known as the Delta Model, named after the Greek letter delta, which stands for transition and change. It was believed that new internet technology offered creative and effective methods to connect with customers and the larger organisation, offering up new sources of strategic positioning that should be thoroughly analysed.

The Delta Model is widely believed to be capable of complementing the viewpoints of Porter’s frameworks and the Resource-Based View of the Firm and providing the integrative glue that may result in a single unified strategy framework.

The Delta model is an acronym of five success factors that are responsible for good contact with customers. All five success factors are needed in the Delta model. When one factor is removed, that affects the remaining four factors and means the balance is lost. Without accessible information, for instance, it will be very difficult to implement this company wide and subsequently use it to make an objective analysis. The five critical success factors are:

- Data

- Enterprise Organisation

- Leadership

- Targets, and

- Analyses

Data (information)

Accessible and qualitative data in the form of information is a first requirement. The rise of the Internet and technologies regarding e-business and e-commerce allow for a new way to approach target audiences (and therefore customers). Information is essential for conducting analyses. Information provided and gathered by the company must also be complete and consistent to appear reliable.

Enterprise Organisation

It’s important to have a company-wide approach. Irrespective of the size of an organisation, information must be accessible in all regions and hierarchical layers. Additionally, it must be possible to disseminate information quickly and in a way that transcends departments. This means that all employees and departments know what’s going on and what they must take into account in their contact with customers.

Leadership

Every organisation requires leadership, according to the Delta model. Each department must be led; that is the only way to allow for decision making based on facts. It’s the task of the leaders to aim for facts rather than simply make decisions based on intuition. Because the accountability lies with the leader, this allows for structured working, which benefits the service to the customers.

Targets

Setting clear targets clarifies to everyone in the organisation what they should be working towards. It’s not all up in the air; a course has been plotted. The most potential value can be identified with a goal in mind. That will lead to success. Of course, sources such as time, money, and employees are just as important. Nevertheless, striving for a good result is impossible without an objective.

Analyses

By means of analyses, an organisation gains knowledge of what they do and whether objectives are achieved. For this purpose, analytical models must be built and maintained. Therefore, it’s necessary to determine beforehand which techniques, algorithms, and models will be used and which are most suitable to address a specific organisational problem. Subsequently, professionals start developing analytical software that can then be used.

Strategic Triangle

The Delta Model can be illustrated using the strategic triangle. There are three points:

- System Lock-In

- Best Customer Solutions, and

- Best Product

System Lock-In

At the summit of the Triangle is the most demanding strategic choice, which we call System Lock-In. In this context, we are addressing the entire network as the relevant scope, acquiring complementors’ share as the ultimate goal, and system economics as the driving force. Those who succeed in achieving this position obtain illegitimate market domination, ensuring not just consumer lock-in but also competition lock-out. Once you’ve reached the lock-in point, it’s difficult to get out because of network effects, which form the traditional virtuous circle: buyers want to buy the computer with the most applications, and software developers want to make applications for the machines with the most installed base. Hax and Wilde identified three potential sources of system lock-in:

- Restricted Access

- Dominant Exchange

- Proprietary Standard

Restricted access

Restricted access (also called an exclusive channel) determines where significant barriers are in place that make it difficult for competitors to compete for the acquisition of customers. Restricted Access is like your Bloomberg terminal. As a trader, if you don’t have your terminal key, you can’t access Bloomberg’s data, software, and services. For Bloomberg, the embedded advantage is that the company has something their customers really need and are willing to pay to enjoy access.

Dominant Exchange

System lock-in also benefits from Dominant Exchange, which is commonly understood as Network Effect businesses. Dominant Exchange businesses provide a platform (or marketplace) between buyers and sellers. Companies like eBay and Airbnb rely on Dominant Exchange economics. The most important aspect of these types of businesses is critical mass and first-mover advantage. Hence, companies such as Uber and Lyft spend significant amount of cash to grow their platforms. Subsequently, it is nearly impossible to replace the incumbent in a dominant exchange marketplace.

Proprietary Standards

Proprietary Standards companies develop a platform or product used by third-party complementors. In other words, it becomes the go-to software, service, etc. Microsoft Windows is a perfect example of a Proprietary Standard. Windows comes standard in every PC on the market. Windows works on any PC (even MacBook). The number of third-party developers that can run on top of the software makes it a no-brainer for computer hardware manufacturers. Microsoft successfully created an entire industry to its benefit in the form of consumers wanting to buy a computer with access to the largest set of applications and software developers (the complements) wanting to write applications for the computers with the largest installed base.

Total Customer Solutions

Total Customers Solutions (TCS), located on the Triangle’s left side, indicates a 180-degree shift from the Best Product positioning. It is the opposite of the Best Product strategy.

Instead of selling standardized and isolated products to depersonalized clients, offer solutions that include a portfolio of customized products and services that constitute a distinct value proposition to individualized customers. The goal of this strategy is to capture the most mind and wallet share.

Rather of operating alone, enlist the relevant group of partners who comprise the extended enterprise. Rather than participating in a war of attrition with competitors, seek collaboration that results in the desired customer bonding. The relevant overall performance metric becomes the total customer share, whose requirements we strive to meet as completely as feasible.

There’s no better example of this strategy than Amazon. Amazon is the king at creating a Total Customer Solution. The mission revolves around free shipping, endless items for sale, and obsessing over the customer.

Disney is another example of Redefining The Customer Experience. Between theme parks, movies, video games, music, and TV shows, Disney captures every step of the consumer’s entertainment journey.

There are three ways businesses achieve TCR:

- Redefining Customer Experience

- Horizontal Breadth

- Customer Integration

Redefining Customer Experience

The goal of RCE is to walk with the customer every step of the way in your product’s lifecycle. You want to know how they use your product, how often they use it, and what problems they solve leveraging your product. In short, you want to build a relationship with the customer.

To quote from strategy+business[1]:

Brands with the best price, coolest product or most memorable marketing campaign might not have an advantage compared with those that exhibit emotional intelligence and communicate with care, honesty, and empathy, and build trust as a result. In times of crisis, people want to be seen and understood, and they are extremely sensitive to tone and motive. Are you reaching out to help them — or to sell them something? Does your outreach feel authentic and caring — or does it appear self-serving?

According to Hax:

As for companies like Fidelity, what guides them is not exclusively their product economics, but also the customer economics, since Fidelity is trying to help the customer in enhancing his or her financial performance in as comprehensive a way as possible.

The only way you can redefine your customer experience is to know your customer inside and out. Hax advices to know the value chain beyond the commoditized process of exchanging goods or services.

Horizontal Breadth

The second way companies can achieve TCS is through Horizontal Breadth. Horizontal Breadth companies offer a complete set of products/services that the customer wants.

Think of Walmart and Amazon. They offer the lowest prices on the largest selection of goods possible. This reduces the need for customers to shop elsewhere.

Fidelity Asset Management is another example. They offer personalized coaching and a variety of investment services that make complex investment activities affordable.

Likewise, IKEA offers all furniture items that people need under one roof. This reduces customer search cost and provides a complete set of what the customer needs.

The goal with Horizontal Breadth is to gain the highest wallet share possible. The more you offer your customer the less they have to spend elsewhere. It’s a simple concept with powerful ramifications.

Customer Integration

The final way companies achieve TCS is through Customer Integration. Hax defines Customer Integration as:

It is outsourcing in its extreme form and at least represents a complex web of connections with the customer that enhance their ability to do business and to use your product.

This strategy has another name: switching costs.

Companies, such as SAP, Oracle, Microsoft, Bloomberg, Salesforce and Google offer products or services are deeply ingrained in the backend of operations that many organizations can’t live without them. Think of all the gaming apps on your phone that require a Facebook login. Or all the Google integrations you have between Gmail, Google Drive and Maps.

Take Oracle software. Imagine how expensive it is to rip out that backend and replace it with something else? Even if that new software is better, faster, and cheaper. You probably wouldn’t do it.

Why? Because those services and products are woven into the fabric of a company’s organization. Taking something like that out is like performing open-heart surgery. If you don’t have to, you won’t.

Best Product Positioning

Best Product Positioning, the strategic choice on the right side of the Triangle, focuses on overall consumer happiness through effective and efficient product creation. There are two approaches to accomplishing the goal:

- Cost Reduction, or

- Product Differentiation

Cost Reduction

The strategy focuses on product economics or the idea that businesses win through rapid innovation and reduction in production costs. In other words, Best Product Positioning shifts the focus from the customer to the product. From customer bonding to production competition.

Based on the current product economics, the position is inward and narrow. The primary strategic driving forces are the development of an efficient supply chain, which ensures low-cost infrastructure, a proven internal capability for new product development, which ensures the proper renewal of the existing product line and the securing of distribution channels, which massively transfer the products to the targeted market segments. Hence, it basically advocates selling standardized and characterized products in order to maximize total consumer satisfaction and beat the competition.

There can only be one lowest-cost company. This leaves little room at the top (or bottom, in this case). Businesses in this environment commoditize their customers, standardize their products, and viciously compete for market share.

One company that dominates the low-cost producer category is Walmart, which prides itself on offering the lowest prices to consumers. At one point their slogan read:

Always low prices

Wallmart can maintain its cost leadership through distribution and supply scale. The sheer size and volume of sales per Wallmart store allow it to bargain with its suppliers for better prices. This means it pays the least for its inventory, which allows it to turn around and sell it at a profit for a cheaper price than its competitors.

Other examples of low-cost producers are Spirit Airlines and Ryanair. These airlines offer no-frills flying experience. Customers only pay for what they want. These airlines pride on low-cost operations, which lets them charge low ticket prices while maintaining profitability. For example Spirit Airlines achieves cost leadership:

Through techniques such as high craft utilization, a high-seat-density configuration, and efficient flight scheduling, the company is able to get more out of each aircraft. The company is also able to save more with less expenditure on sales and marketing expenses by selling directly to customers and outsourcing non-core functions. Spirit Airlines has one of the lowest operating costs per seat in the industry.

Finally, we Costco’s low-cost business model is a case in point. The company operates under razor-thin product margins, which allows it to offer the lowest price to its customers.

Product Differentiation

Businesses that can’t compete on price must find another way to gain market share. They do this through Product Differentiation.

There are many ways companies can differentiate their products:

- Features

- Performance & Quality

- Reliability

- Looks

- Channels of Distribution

- Complexity

- Location

- Marketing Efforts

We can group product differentiation into three buckets:

- Horizontal

- Vertical, and

- Simple

Horizontal

Horizontal differentiation deals with commoditized products, like water bottles or ice cream. There’s not much distinction between the two products, so you choose based on other things like branding, etc.

A great example of this is Coke vs. Pepsi. At the end of the day, horizontal differentiation is simply personal preference.

Vertical

Vertical differentiation involves the quality of goods and services. In vertical competition, price matters. The more something costs, the higher the perceived quality. This is why people buy Duracell over generic batteries. Or some people buy plain black shirts from J Crew instead of H&M.

Simple

Simple differentiation is a combination of vertical and horizontal. There’s more personal preference involved, but that personal preference is based on what you consider quality.

Take Apple vs. Android. That’s a simple differentiation problem. People choose Apple because they believe it’s a better product with a simpler UI. Others choose Android because of its functionality, customization and processing abilities.

Best Product strategies are the least attractive forms of competitive advantage. Low-cost providers are great businesses, but it’s hard to achieve the scale necessary to offer such low prices. That leaves product differentiation — which is a loser’s game over time. Competitors copy every innovation and differentiation attempt, leaving a commoditized wasteland of low-margin goods (see, PC hardware).

Adaptive Processes

In Hax’s Delta Model, adaptive processes play a vital role in achieving the strategic options of the triangle that the business chooses to adopt. They entail how the company and its several segments and processes must be aligned with the chosen strategic option. Hax’s Delta Model provides three business adaptive processes to achieve this purpose:

- Operational Effectiveness

- Customer Targeting, and

- Innovation

Operational Effectiveness

Focuses on establishing an efficient extended supply chain, including customers, suppliers, and key complementors to expand the business’ delivery scope. Its primary focus is on producing the most effective cost and asset infrastructure to support the desired strategic option adopted by the business.

Customer Targeting

Focuses on developing and executing activities that attract, satisfy, and retain consumer bases. It emphasizes managing customer relationships effectively. Its primary focus is on attracting customer bases and maximizing their financial utility and satisfaction.

Innovation

Focuses on ensuring a continuous stream of new products and services by innovation. It emphasizes mobilizing all creative resources available, i.e., technical resources + production resources + marketing capabilities, etc., to encourage and introduce innovation in the business. It helps the business keep their game up and always maintain an upper hand over the competition.

Case Study – Castrol

Castrol is one of the world’s leading lubricant companies. They concluded that the Best Product approach was doomed since the business was becoming commoditized and differentiation through premium items was not creating long-term competitive advantage. Selling lubricants by the gallon was not an appealing prospect. They were introduced to the Triangle at the time and opted to focus their efforts on pursuing a Total Customer Solutions strategy.

They began by carefully segmenting their customer base. Castrol accomplished this by identifying the primary business application clusters: cement, sugar, pulp and paper, textile, food and beverage, wood, mining, and glass. But it wasn’t enough. Castrol’s smart next move was to identify which clients to target with various degrees of priority within each market segment. They accomplished this goal by recognizing the clients’ views toward accepting a full Total Customer Solutions strategy.They considered three Tiers.

Primary Target Segment: Productivity Conscious Customers. These customers are eager to receive support that will enhance their productivity, reduce total costs, and promote higher sales

Secondary Target Segment: Cost Conscious Customers. These customers are concerned about total costs but they believe new production does not necessarily yield higher sales or economies of scale

The Least Desirable Segment: Price Conscious Customers. These customers are basically buying from the supplier that offers the lowest price

This level of client segmentation is essential since you cannot and should not treat all customers identically. Not all clients are equally open to a method that demands additional effort on both sides while potentially yielding far larger advantages.

Castrol’s value proposition for the primary targeted customers was as follows:

A specially designed lubrication programme that includes both goods and services and leads to quantifiable cost savings and productivity gains. The delivery of this value proposition was supported by a completely different customer engagement process. The lesson of Castrol is enormously impacting for a proper decommoditization of a product offering: do not treat each customer equally, sell solutions not products, document your value proposition, bring in the executive team to develop long-term relations based on learning, trust, and mutual benefits.

Haxioms

Hax is known for the Delta Model. But he opines a set of principles (he calls Haxioms) for organizations to follow:

- Haxiom 1: The center of the strategy is the customer. This is the center of the Delta Model, being the customer the driving force for all actions undertaken by the company. Thus, the effort the Organizations have to do is to configure high value-added propositions to customers which will be both creative and unique

- Haxiom 2: You don’t win by beating the competition. You win by achieving Customer Bonding. Just as the central focus of the management is the Customer, the central focus of the strategy should be Customer Bonding. This stage is recognizable by a relationship based on transparency, fairness, and which produces long term benefits for all involved

- Haxiom 3: Strategy is not war; it is Love. When we define the essence of strategy as a competitive advantage, we are at the same time denoting conflict as the way to think about business. If instead we reject this notion, our mind opens up to new alternatives and, since we are no longer in confrontation with our partners, other forms of cooperation can be considered. The extreme way of non-conflict is indeed LOVE

- Haxiom 4: A product-centric mentality is constraining; open your mindset to include the customers, the suppliers and the complementors as your key constituencies. Since all business are related and dependent on other members of the supply chain, a wider view is needed to see this expanded enterprise, which is the entity of real importance in our strategic analysis. In this way we can better propose high-value propositions to our customers

- Haxiom 5: Try to understand your customer deeply. Strategy is done one customer at a time. The granular customer analysis is fundamental to complete a sensible customer segmentation. the extreme is in fact the consideration of each single customer individually with his/her own needs and wants

- Haxiom 6: Commodities only exist in the mind of the inept

- Haxiom 7: The foundations of strategy are two: 1. Customer segmentation and customer value proposition 2. The firm as a bundle of competencies

- Haxiom 8: Reject the two truisms: the customer is always right and I know the customers need and how to satisfy them. This principle by Hax argues that the customer cannot always be right as the customer has no idea what can be offered to them and if a close relationship has not been formed between the customer and business, how can the business understand their needs. Satisfaction can only be achieved by working jointly with the customers

- Haxiom 9: The strategic planning process is a dialogue among the key executives of the firm seeking a consensus on the direction of the organizations

- Haxiom 10: Metrics are essential; experimentation is crucial

References