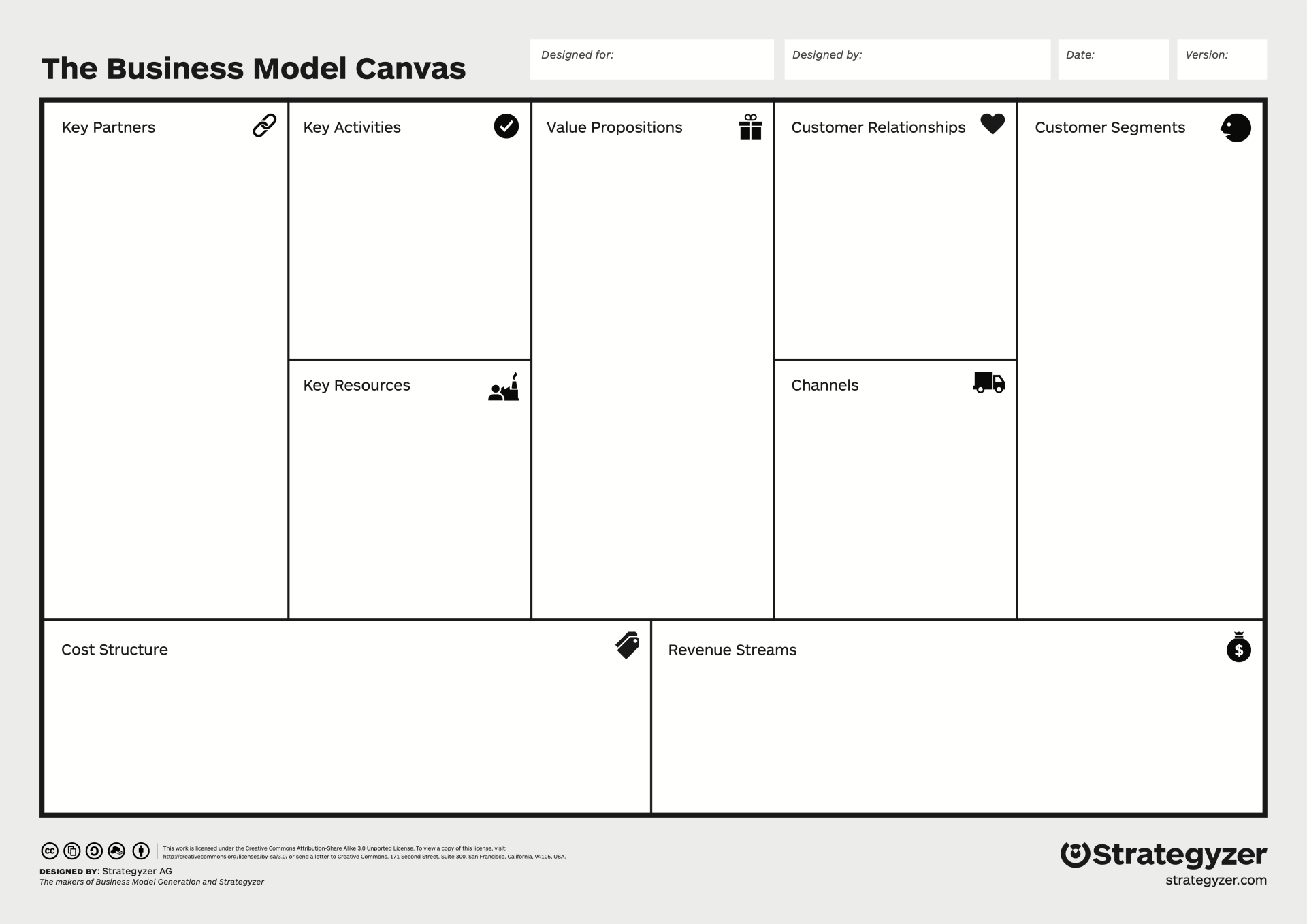

A shared language is imperative to systematically challenge assumptions about one’s business model and innovate successfully, creating strategic alternatives. At the same time, it must be simple, relevant, and intuitively understandable, while not oversimplifying the complexities of how enterprises function. In just 9 building blocks, using the canvas anyone can understand how a company intends to make money. The nine blocks cover the four main areas of a business: customers, oΩer, infrastructure, and financial viability. The business model is like a blueprint for a strategy to be implemented through organizational structures, processes, and systems.

Business Model Canvas

The Model

The 9 building blocks of the Lean Canvas can be described in the following manner:

- Customer Segments: An organization serves one or several Customer Segments

- Value Proposition: It seeks to solve customer problems and satisfy customer needs with value propositions

- Channels: Value propositions are delivered to customers through communication, distribution, and sales channels

- Customer Relationships: Customer relationships are established and maintained with each Customer Segment

- Revenue Streams: Revenue streams result from value propositions successfully offered to customers

- Key Resources: Key resources are the assets required to offer and deliver the previously described elements

- Key Activities: y performing several Key Activities

- Key Partnerships: Some activities are outsourced, and some resources are acquired outside the enterprise

- Cost Structure: The business model elements result in the cost structure

Customer Segments

Ascertaining accessible and profitable customer segments is of primary importance while planning a business. To streamline the planning process, segments may be chosen on the basis of demographic, income or psychographic considerations. A business model may define one or several large or small Customer Segments. An organization must make a conscious decision about which segments to serve and which segments to ignore, post which, a business model can be structured around catering to specific customer needs.

Mass market

Business models catering to mass markets scarcely differentiate among Customer Segments. The Value Propositions, Distribution Channels, and Customer Relationships all focus on one large group of customers with broadly similar needs and problems. This type of business model is often found, for example, in the consumer electronics sector.

Niche market

Business models targeting niche markets focus on specific Customer Segments. The Value Propositions, Distribution Channels, and Customer Relationships are all tailored to the specific requirements of a niche market. Such business models are often found in supplier-buyer relationships. For example, many car part manufacturers depend heavily on purchases from major automobile manufacturers.

Segmented

Some business models distinguish between market segments having different requirements. The retail arm of a bank like Credit Suisse, for example, may distinguish between a large group of customers, each possessing assets of up to U.S. $100,000, and a smaller group of affluent clients, each of whose net worth exceeds U.S. $500,000. This has implications for the other building blocks of Credit Suisse’s business model, such as the Value Proposition, Distribution Channels, Customer Relationships, and Revenue streams. Another example is Micro Precision Systems, which specializes in providing outsourced micromechanical design and manufacturing solutions. It serves three different Customer Segments—the watch industry, the medical industry, and the industrial automation sector—and offers each different Value Propositions.

Diversified

An organization with a diversified customer business model serves two unrelated Customer Segments with very different needs and problems. For example, in 2006, Amazon.com decided to diversify its retail business by selling “cloud computing” services: online storage space and on-demand server usage. Thus, it started catering to a totally different Customer Segment—Web companies—with a totally different Value Proposition. The strategic rationale behind this diversification can be found in Amazon. Om’s powerful IT infrastructure, which can be shared by its retail sales operations and the new cloud computing service unit.

Multi-sided platforms

Some organizations serve two or more interdependent Customer Segments. A credit card company, for example, needs a large base of credit card holders and a large base of merchants who accept those credit cards. Similarly, an enterprise offering a free newspaper needs a large reader base to attract advertisers. On the other hand, it also needs advertisers to finance production and distribution. Both segments are required to make the business model work.

Value Proposition

The Value Proposition is the reason why customers turn to one company over any others. It solves a customer’s problem or satisfies a customer’s need. Each Value Proposition consists of a selected bundle of products and/or services that caters to the requirements of a specific Customer Segment. The Value Proposition, thus, is an aggregation of the benefits that a company offers customers.

Novelty

Some Value Propositions satisfy an entirely new set of needs that customers previously didn’t perceive because there were no similar offerings. This is often, but not always, technology-related. Cell phones, for instance, created a whole new industry around mobile telecommunication. On the other hand, products such as ethical investment funds have little to do with new technology.

Performance

Improving product or service performance has traditionally been a common way to create value. The PC sector has traditionally relied on this factor by bringing more powerful machines to market. But improved performance has its limits. In recent years, for example, faster PCs, more disk storage space, and better graphics have failed to produce corresponding growth in customer demand.

Customization

Tailoring products and services to the specific needs of individual customers or Customer Segments creates value. In recent years, the concepts of mass customization and customer co-creation have gained importance. This approach allows for customized products and services, while still taking advantage of economies of scale.

Utility

Value can be created simply by helping a customer get certain jobs done. Rolls-Royce understands this very well: its airline customers rely entirely on Rolls-Royce to manufacture and service their jet engines. This arrangement allows customers to focus on running their airlines. In return, the airlines pay Rolls-Royce a fee for every hour an engine runs.

Design

Design is an important but difficult element to measure. A product may stand out because of its superior design. In the fashion and consumer electronics industries, design can be a particularly important part of the Value Proposition.

Brand / Status

Customers may find value in the simple act of using and displaying a specific brand. Wearing a Rolex watch signifies wealth, for example. On the other end of the spectrum, skateboarders may wear the latest “underground” brands to show that they are “in.”

Price

Offering similar value at a lower price is a common way to satisfy the needs of price-sensitive Customer Segments. But low-price Value Propositions have important implications for the rest of a business model. No-frills airlines, such as Southwest, EasyJet, and Ryanair have designed entire business models specifically to enable low-cost air travel. Another example of a price-based Value Proposition can be seen in the Nano, a new car designed and manufactured by the Indian conglomerate Tata. Its surprisingly low price made the automobile affordable to a whole new segment of the Indian population.

Cost reduction

Helping customers reduce costs is an important way to create value. Salesforce.com, for example, sells a hosted Customer Relationship Management (CRM) application. This relieves buyers from the expense and trouble of having to buy, install, and manage CRM software themselves.

Risk reduction

Customers value reducing the risks they incur when purchasing products or services. For a used car buyer, a one-year service guarantee reduces the risk of post-purchase breakdowns and repairs. A service-level guarantee partially reduces the risk undertaken by a purchaser of outsourced IT services.

Accessibility

Making products and services available to customers who previously lacked access to them is another way to create value. This can result from business model innovation, new technologies, or a combination of both. NetJets, for instance, popularized the concept of fractional private jet ownership. Using an innovative business model, NetJets offers individuals and corporations access to private jets, a service previously unaffordable to most customers. Mutual funds provide another example of value creation through increased accessibility. This innovative financial product made it possible even for those with modest wealth to build diversified investment portfolios.

Convenience / Usability

Making things more convenient or easier to use can create substantial value. With iPod and iTunes, Apple offered customers unprecedented convenience searching, buying, downloading, and listening to digital music. It now dominates the market.

Channels

Communication, distribution, and sales Channels comprise a company’s interface with customers. This building block also defines how an organization will communicate with and provide value to its chosen customer segments. Channels are customer touch points that play an important role in the customer experience. Channels can be categorized as marketing, sales or distribution channels.

Channels and Customer Relationships are directly linked to the how of a company linking with its target customer segment. Most companies have a different medium to attract a customer and separate strategies on how to retain them. It is advisable to list separate channels for different customer segments if your organization is targeting more than one.

The Channel Building Block describes how a company communicates with and reaches its Customer Segments to deliver its Value Proposition. It is important to understand which pathway (or channel) is best for your company to reach your customers. An organization can choose between reaching its customers through its own channels (B2C), partner channels (B2B), or through a mixture of both.

Channel Functions

- Raising awareness among customers about a company’s products and services

- Helping customers evaluate a company’s Value Proposition

- Allowing customers to purchase specific products and services

- Delivering a Value Proposition to customers

- Providing post-purchase customer support

Requirements

- Through which channels do our Customer Segments want to be reached?

- How are we reaching them now?

- How are our channels integrated?

- Which ones work best?

- Which ones are most cost-efficient?

- How are we integrating them with customer routines?

Channel Phases

There are five phases through which a channel passes. A channel can cover more than one of these phases at a time.

Awareness

How do we raise awareness about our company’s products and services? How do we educate customers about the characteristics of the products and services? This is the marketing and advertising phase. It is how you let your customer know about your value proposition through advertising (Word of Mouth, Social Media, Newspaper, etc.)

Evaluation

How do we help customers evaluate our organization’s value proposition? How can we aid customers in evaluating our Value Proposition? This is the promotion or ‘Try me before you buy me’ phase. The customer will evaluate, read about or use your product and form an opinion about it. A good company will educate customers with other competitors in the market and help them to evaluate their choices. In this way, you make your value proposition clearer to them and why you are a better option than your competitors.

Surveys and reviews are excellent tools to deploy during the evaluation phase. These tools also help the organization source features from customer feedback.

Purchase

How do we allow customers to purchase specific products and services? How can we help customers in buying their preferred product or service? This is the sales process and denoted the dollars exchanged for a particular goods and services.

Some of the purchase channels are via the Web, Brick and Mortar or self checkout (as with Amazon Go).

Delivery

How do we deliver the promised value proposition to the customer? This is the fulfillment stage and defines how the product will reach the customer.

After Sales

How can we provide After Sales customer care and support? This phase creates Advocates for your products and services amongst your target segment. This stage provides a person for the customer to call when they have a problem or question about the product. The higher the value of the product, the more likely it is that he/ she will require After Sales support. Call center, return policy and customer support / assistance hotline are established conduits for this phase.

Channel Types

This is the bridge between the customer and the company. There are different channel types.

Own Channels

A direct channel will include your sales force that would go after your customer segment and bring them in. A website is another direct channel that can be under the company’s control.

You may also have your store, however the customer must choose to go to the store and then you can sell to him/ her, but this will be indirect selling.

By employing your own channel, you will have a direct relationship with the customer, and you will have higher profit margins. However, you will require more investment to create the infrastructure to deliver your product to the market, and the production to market loop will be slower. Additionally partners leverage long established relationships with retailers that you will not have access to.

Partner Channels

This is an indirect channel. In this case, the company will not sell to the customer directly but through an intermediary.

The company can do this by placing their products or making their services available at the partner store.

Wholesalers are also partner channels. Wineries create partnerships with wholesalers in different countries to sell their wine to the end customer.

With a partner channel, there will be a lower margin on the product but it would get to the market quicker, and there will be lesser investment required in infrastructure.

Heineken delivers their beer to wholesalers, bars and shops, supermarkets as well as retail chains such as Gall and Gall, a retail chain of liquor with its distribution channels. Alternatively, Heineken also delivers to its network of bars to which it delivers directly. Hence, Heineken uses different Distribution channels to reach its customers.

Apple has its network of stores as well as premium resellers. They also sell their products through mobile networks, retail chains, and websites. Hence, there are different distribution channels in use at the same time with varying profitability. Their stores are extremely well-developed as well as experiential for any consumer that walks in. This may impact the profitability of the store, but it also allows Apple to communicate an entire experience to its consumer, and through this experience, establish a direct relationship with the customer.

Distribution

Direct distribution

This can be done through personal selling, the internet, telephone or mail.

Personal Selling

In the case of personal selling, there is a lot of conveniences afforded to the customer including personal demonstration, home delivery, and satisfaction guarantees. The cost of a direct selling channel, especially if it is based on personal selling is low and can be easily afforded by an individual starting a business. Personal selling is a wonderful way to establish a strong relationship with the customer and gain insight into big customers’ preferences. The Return on Investment in personal selling is also higher, and the company can exert control over the brand image and positioning of the company.

However, if the organization is bigger, personal selling costs can be prohibitive. This particular distribution channel is also limited in its reach and creates too much dependence on people who may leave the organization and take their clients with them.

The Internet

The internet, on the other hand, provides a low-cost channel to target a wide customer base. It also provides convenience to customers in the form of instant access, ease of use and personalization. It is also a wonderful source of information for the customers is available 24/7 and gives them the chance to establish two-way communication with the company by letting them provide feedback and share preferences.

Conversely, the internet is an impersonal tool that does not allow the customer and the company to establish human contact. There is also the possibility of annoying customers by sending them too much spam. It also limits how the customer can directly interact with the product and requires an infrastructural investment. There is also a lack of after-sales service opportunities.

Telephone

The telephone is an inexpensive ad efficient way to establish direct contact with the customer. It is also a good way to establish a relationship, create leads and reach customers in remote areas. On the other hand, the telephone, due to being outsourced to third world countries and used as a medium for marketing may seem intrusive and annoying to customers.

Mail / Email

Mail is another direct medium that is inexpensive and can reach a large audience. It is also easily customizable to different customer segments and allows for easy alteration. It is a wonderful way to create a brand image, communicate innovations or new products and foster good will. Again there are challenges with this medium such as the possibility that customers consider it junk mail or choose to never peruse its contents. This medium in general has low ROI.

Indirect Distribution

Indirect distribution can be carried out through retailers, agents/ brokers/ reps and distributors.

Retailers

Retailers come with many positives such as already established infrastructures of stores, webpages, and aggressive marketing strategies. Retailers have their established brands that can provide a bolster to the already existing brand. There is also personal service and after sales services provided by the retailer, as well as a being a source of market and consumer intelligence.

This channel, however, leads to lower margins and loss of control. There is a disconnect from the end customer, and the retailer may be stocking competing brands side by side. This is a complex channel that can be expensive for a new business.

Agents and Brokers

Agents, brokers or reps provide personal selling and have established relationships with customers. They have a broad network, lesser distribution costs and are a source of market intelligence. They also assume the role of promoting the product, as well as share the burden of overhead costs.

Conversely, this channel is more sensitive to pricing, difficult to control and train. They may represent competing brands and maintain loyalty to the highest selling brand. This channel also means the company has less control over its brand image and no opportunity to establish a direct relationship with the client.

Distributors

Finally, distributors have a focused customer base, assume inventory risk, have a wider reach and are technically trained. However, they carry competing brands, have a say in the final pricing of your product and your company does not have control over the final look of the product to the customer. They also have low customer intelligence and represent an additional investment.

Google is the largest technological company in the world. Its main product is its search engine that is the most used search engine in today’s day and age. Google employs two channels to deliver its value propositions to its customer segments. It has created Global Sales and Support teams as well as a Multi-product Sales force.

For its individual customers, Google has a DIY approach with a high level of automation to make the process convenient and to appeal to the average Googler. Google’s Global Sales and Support team consists of specialized teams across industries that establish relationships with advertisers and network members and aid them in gaining maximum value from their relationship with Google.

Google’s sales force sells Search, Display and Mobile advertising and is focused on fostering relationships with major advertisers and premium internet companies.

Customer Relationships

A company should clarify the type of relationship it wants to establish with each Customer Segment. Relationships can range from personal to automated. Customer relationships may be driven by the following motivations

- Customer acquisition

- Customer retention

- Boosting sales (upselling)

Personal assistance

This relationship is based on human interaction. The customer can communicate with a real customer representative to get help during the sales process or after the purchase is complete. This may happen onsite at the point of sale, through call centers, by e-mail, or through other means.

Dedicated personal assistance

This relationship involves dedicating a customer representative specifically to an individual client. It represents the deepest and most intimate type of relationship and normally develops over a long period of time. In private banking services, for example, dedicated bankers serve high net worth individuals. Similar relationships can be found in other businesses in the form of key account managers who maintain personal relationships with important customers.

Self-service

In this type of relationship, a company maintains no direct relationship with customers. It provides all the necessary means for customers to help themselves.

Automated services

This type of relationship mixes a more sophisticated form of customer self-service with automated processes. For example, personal online profiles give customers access to customized services. Automated services can recognize individual customers and their characteristics, and offer information related to orders or transactions. At their best, automated services can simulate a personal relationship (e.g. offering book or movie recommendations).

Communities

Increasingly, companies are utilizing user communities to become more involved with customers/prospects and to facilitate connections between community members. Many companies maintain online communities that allow users to exchange knowledge and solve each other’s problems. Communities can also help companies better understand their customers. Pharmaceutical giant GlaxoSmithKline launched a private online community when it introduced alli, a new prescription-free weight-loss product. GlaxoSmithKline wanted to increase its understanding of the challenges faced by overweight adults, and thereby learn to better manage customer expectations.

Co-creation

More companies are going beyond the traditional customer-vendor relationship to co-create value with customers. Amazon.com invites customers to write reviews and thus create value for other book lovers. Some companies engage customers to assist with the design of new and innovative products. Others, such as YouTube.com, solicit customers to create content for public consumption.

Revenue Streams

A company must ascertain the value each Customer Segment is truly willing to pay. Successfully answering that question allows the firm to generate one or more Revenue Streams from each Customer Segment. Each Revenue Stream may have different pricing mechanisms, such as fixed list prices, bargaining, auctioning, market dependent, volume dependent, or yield management.

Asset sale

The most widely understood Revenue Stream derives from selling ownership rights to a physical product. Amazon.com sells books, music, consumer electronics, and more online. Fiat sells automobiles, which buyers are free to drive, resell, or even destroy.

Usage fee

This Revenue Stream is generated using a particular service. The more a service is used, the more the customer pays. A telecom operator may charge customers for the number of minutes spent on the phone. A hotel charges customers for the number of nights rooms are used. A package delivery service charges customers for the delivery of a parcel from one location to another.

Subscription fees

This Revenue Stream is generated by selling continuous access to a service. A gym sells its members monthly or yearly subscriptions in exchange for access to its exercise facilities. World of Warcraft Online, a Web-based computer game, allows users to play its online game in exchange for a monthly subscription fee. Nokia’s comes with music service gives users access to a music library for a subscription fee.

Lending / Renting / Leasing

This Revenue Stream is created by temporarily granting someone the exclusive right to use a particular asset for a fixed period in return for a fee. For the lender this provides the advantage of recurring revenues. Renters or lessees, on the other hand, enjoy the benefits of incurring expenses for only a limited time rather than bearing the full costs for what value are our customers really willing to pay? For what do they currently pay? How are they currently paying? How would they prefer to pay? How much does each Revenue Stream contribute to overall revenues? of ownership. Zipcar.com provides a good illustration. The company allows customers to rent cars by the hour in North American cities. Zipcar.com’s service has led many people to decide to rent rather than purchase automobiles.

Licensing

This Revenue Stream is generated by giving customers permission to use protected intellectual property in exchange for licensing fees. Licensing allows rights holders to generate revenues from their property without having to manufacture a product or commercialize a service. Licensing is common in the media industry, where content owners retain copyright while selling usage licenses to third parties. Similarly, in technology sectors, patent holders grant other companies the right to use a patented technology in return for a license fee.

Brokerage fees

This Revenue Stream derives from intermediation services performed on behalf of two or more parties. Credit card providers, for example, earn revenues by taking a percentage of the value of each sales transaction executed between credit card merchants and customers. Brokers and real estate agents earn a commission each time they successfully match a buyer and seller.

Advertising

This Revenue Stream results from fees for advertising a particular product, service, or brand. Traditionally, the media industry and event organizers relied heavily on revenues from advertising. In recent years other sectors, including software and services, have started relying more heavily on advertising revenues.

Key Resources

Key Resources allow an enterprise to create and offer a Value Proposition, reach markets, maintain relationships with Customer Segments, and earn revenues. Different Key Resources are needed depending on the type of business model. A microchip manufacturer requires capital-intensive production facilities, whereas a microchip designer focuses more on human resources. Key resources can be physical, financial, intellectual, or human. Key resources can be owned or leased by the company or acquired from key partners.

Physical

This category includes physical assets such as manufacturing facilities, buildings, vehicles, machines, systems, point-of-sales systems, and distribution networks. Retailers like Wal-Mart and Amazon.com rely heavily on physical resources, which are often capital-intensive. The former has an enormous global network of stores and related logistics infrastructure. The latter has an extensive IT, warehouse, and logistics infrastructure.

Intellectual

Intellectual resources such as brands, proprietary knowledge, patents and copyrights, partnerships, and customer databases are increasingly important components of a strong business model. Intellectual resources are difficult to develop but when successfully created may oΩer substantial value. Consumer goods companies such as Nike and Sony rely heavily on a brand as a Key Resource. Microsoft and SAP depend on software and related intellectual property developed over many years. Qualcomm, a designer and supplier of chipsets for broadband mobile devices, built its business model around patented microchip designs that earn the company substantial licensing fees.

Human

Every enterprise requires human resources, but people are particularly prominent in certain business models. For example, human resources are crucial in knowledge-intensive and creative industries. A pharmaceutical company such as Novartis, for example, relies heavily on human resources: Its business model is predicated on an army of experienced scientists and a large and skilled sales force.

Financial

Some business models call for financial resources and/or financial guarantees, such as cash, lines of credit, or a stock option pool for hiring key employees. Ericsson, the telecom manufacturer, provides an example of financial resource leverage within a business model. Ericsson may opt to borrow funds from banks and capital markets, then use a portion of the proceeds to provide vendor financing to equipment customers, thus ensuring that orders are placed with Ericsson rather than competitors.

Key Activities

Every business model calls for a number of Key Activities. These are the most important actions a company must take to operate successfully. They are required to create and offer a Value Proposition, reach markets, maintain Customer Relationships, and earn revenues. Key Activities differ depending on business model type. For software maker Microsoft, Key Activities include software development. For PC manufacturer Dell, Key Activities include supply chain management. For consultancy McKinsey, Key Activities include problem solving.

Production

These activities relate to designing, making, and delivering a product in substantial quantities and/or of superior quality. Production activity dominates the business models of manufacturing firms.

Problem-solving

Key Activities of this type relate to coming up with new solutions to individual customer problems. The operations of consultancies, hospitals, and other service organizations are typically dominated by problem-solving activities. Their business models call for activities such as knowledge management and continuous training.

Platform / network

Business models designed with a platform as a Key Resource are dominated by platform or network related Key Activities. Networks, matchmaking platforms, software, and even brands can function as a platform. eBay’s business model requires that the company continually develop and maintain its platform: the Web site at eBay.com. Visa’s business model requires activities related to its Visa® credit card transaction platform for merchants, customers, and banks. Microsoft’s business model requires managing the interface between other vendors’ software and its Windows® operating system platform. Key Activities in this category relate to platform management, service provisioning, and platform promotion.

Key Partnerships

The Key Partnerships Building Block describes the network of suppliers and partners that make the business model work Companies forge partnerships for many reasons, and partnerships are becoming a cornerstone of many business models. Companies create alliances to optimize their business models, reduce risk, or acquire resources. We can distinguish between four different types of partnerships:

- Strategic alliances between non-competitors

- Co-opetition: strategic partnerships between competitors

- Joint ventures to develop new businesses

- Buyer-supplier relationships to assure reliable supplies

Each of these partnerships is designed to:

- Optimize costs and achieve Economies of Scale

- Mitigate Risks and Uncertainty in competitive environments

- Acquisition of particular resources and activities

Cost Structure

This building block describes the most important costs incurred while operating under a particular business model. Creating and delivering value, maintaining Customer Relationships, and generating revenue all incur costs. Such costs can be calculated relatively easily after defining Key Resources, Key Activities, and Key Partnerships.

Naturally enough, costs should be minimized in every business model. But low-Cost Structures are more important to some business models than to others. Therefore, it can be useful to distinguish between two broad classes of business model Cost Structures: cost-driven and value-driven (many business models fall in between these two extremes):

Cost-driven

Cost-driven business models focus on minimizing costs wherever possible. This approach aims at creating and maintaining the leanest possible Cost Structure, using low price Value Propositions, maximum automation, and extensive outsourcing. No-frills airlines, such as Southwest, EasyJet, and Ryanair typify cost-driven business models.

Value-driven

Some companies are less concerned with the cost implications of a particular business model design, and instead focus on value creation. Premium Value Propositions and a high degree of personalized service usually characterize value-driven business models. Luxury hotels, with their lavish facilities and exclusive services, fall into this category. Cost Structures can have the following characteristics:

Fixed costs

Costs that remain the same despite the volume of goods or services produced. Examples include salaries, rents, and physical manufacturing facilities. Some businesses, such as manufacturing companies, are characterized by a high proportion of fixed costs. The most common examples of fixed costs include lease and rent payments, utilities, insurance, certain salaries, and interest payments.

While variable costs tend to remain flat, the impact of fixed costs on a company’s net income can change based on the number of products it produces. When production increases, the fixed costs drop. The price of a greater amount of goods can be spread over the same amount of a fixed cost.

For example, a company has a lease of $10,000 a month on its production facility and it produces 1,000 mugs per month. As such, it may spread the fixed cost of the lease at $10 per mug. If it produces 10,000 mugs a month, the fixed cost of the lease goes down, to the tune of $1 per mug.

Variable costs

Costs that vary proportionally with the volume of goods or services produced. Some businesses, such as music festivals, are characterized by a high proportion of variable costs. Examples of variable costs include a manufacturing company’s costs of raw materials and packaging—or a retail company’s credit card transaction fees or shipping expenses, which rise or fall with sales.

If companies ramp up production to meet demand, their variable costs will increase as well. If these costs increase at a rate that exceeds the profits generated from new units produced, it may not make sense to expand. A company in such a case will need to evaluate why it cannot achieve economies of scale. In economies of scale, variable costs as a percentage of overall cost per unit decrease as the scale of production ramps up.

Economies Of Scale

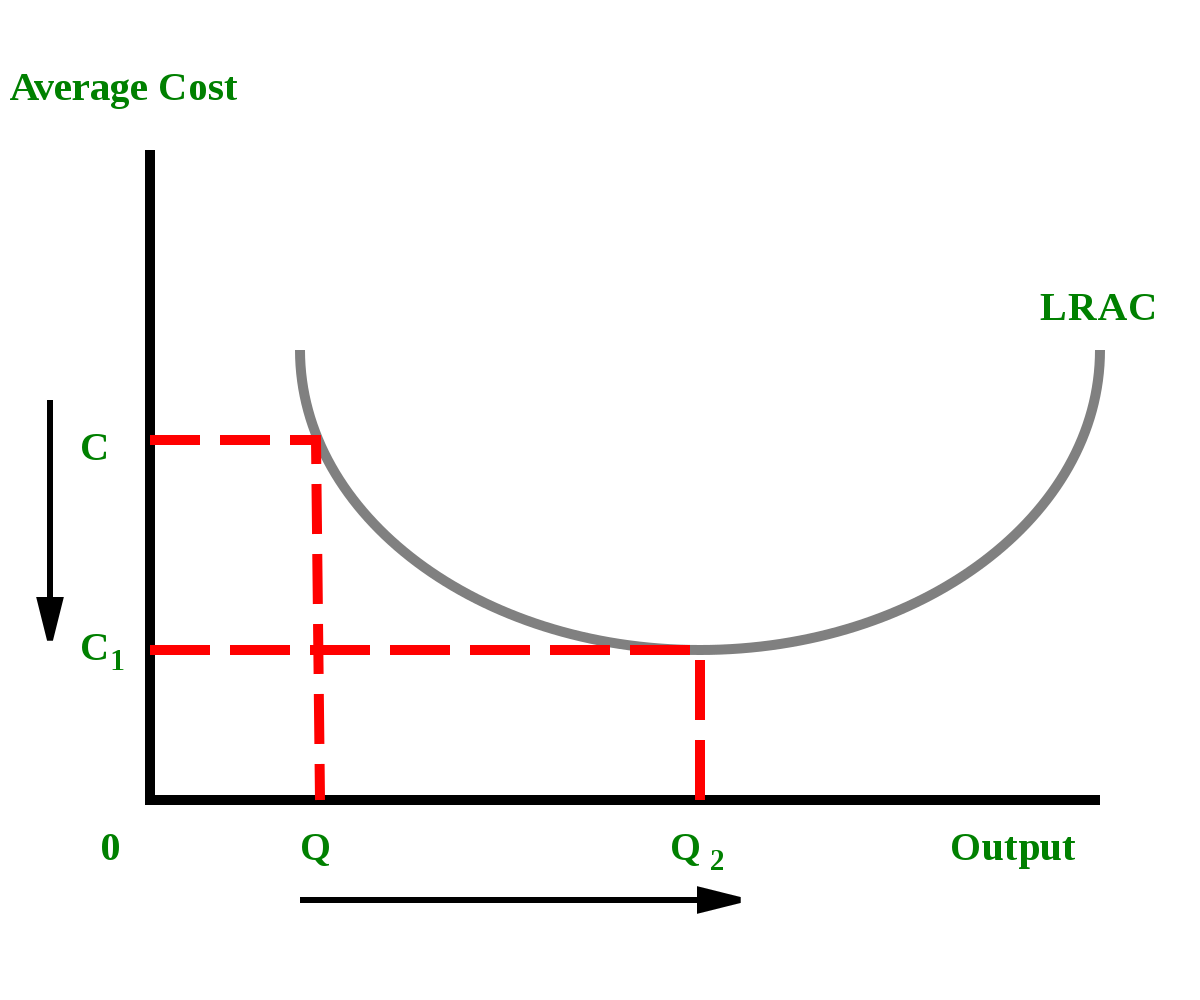

Cost advantages that a business enjoys as its output expands. Larger companies, for instance, benefit from lower bulk purchase rates. This and other factors cause average cost per unit to fall as output rises.

Economies of Scale

This diagram shows that as firms increase output from Q to Q2, average costs fall from C to C1. Any further increase in output only further increases the average cost of the operation.

Types Of Economies Of Scale

There are many different types and examples of how firms can benefit from economies of scale – including specialization, bulk buying, and the use of assembly lines.

Types of Economies of Scale

1. Internal Economies of Scale

2. External Economies of Scale

Internal Economies of Scale

This refers to economies that are unique to a firm. For instance, a firm may hold a patent over a mass production machine, which allows it to lower its average cost of production more than other firms in the industry.

External Economies of Scale

These refer to economies of scale enjoyed by an entire industry. For instance, suppose the government wants to increase steel production. In order to do so, the government announces that all steel producers who employ more than 10,000 workers will be given a 20% tax break.

Thus, firms employing less than 10,000 workers can potentially lower their average cost of production by employing more workers. This is an example of an external economy of scale – one that affects an entire industry or sector of the economy.

Sources of Economies of Scale

Purchasing

Firms might be able to lower average costs by buying the inputs required for the production process in bulk or from special wholesalers. By negotiating with suppliers for volume discounts, the purchasing firm takes advantage of economies of scale.

Managerial

Firms might be able to lower average costs by improving the management structure within the firm. The firm might hire better skilled or more experienced managers.

Technological

A technological advancement might drastically change the production process. For instance, fracking completely changed the oil industry a few years ago. However, only large oil firms that could afford to invest in expensive fracking equipment could take advantage of the new technology.

Supermarkets can benefit from economies of scale because they can buy food in bulk and get lower average costs. If you had a delivery of just 100 cartons of milk the average cost is quite high. The marginal cost of delivering 10,000 cartons is quite low. You still need to pay only one driver; the fuel costs will be similar. The average cost of transporting 10,000 is a lot less than transporting 100.

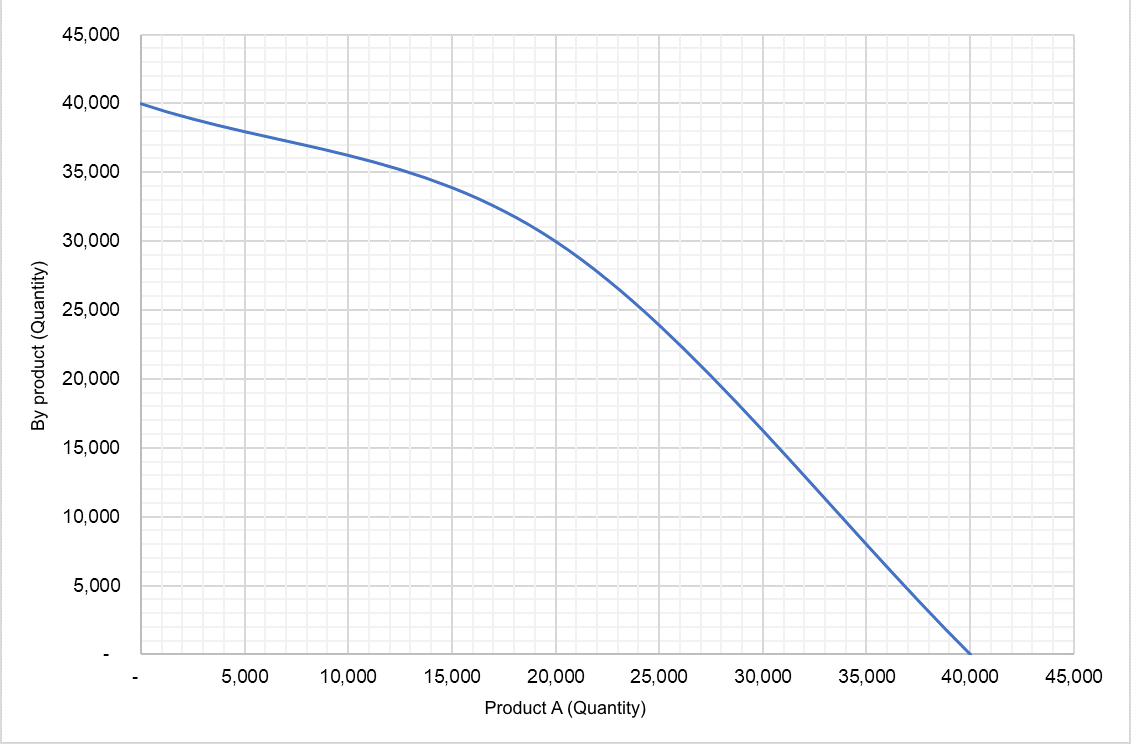

Economies of scope

Economies of scope represent the production efficiency which enables a firm to produce more than one products at a cost which is lower than the sum of stand-alone costs of each product. Cost advantages result from a larger scope of operations. In a large enterprise, for example, the same marketing activities or Distribution Channels may support multiple products.

Economies of Scope

Production possibility frontier (also called production possibility curve) is a plot that shows the maximum outputs that an economy can produce from the available inputs (i.e. factors of production). Since resources are scarce, deciding about what to produce is of pivotal importance for individuals, firms, governments and whole economies. Production possibility frontier is a good tool that helps decision-makers imagine their production choices and tradeoffs and determine whether they are producing at their full potential.Economies of scope can occur, for example, when the by-product of a firm’s main production process can be used to produce another product cheaply, when the firm has a fixed resource such as a license which can be used to offer new products at minimal additional cost, when the firm’s supply chain can be leveraged to introduce another product at no additional cost, etc. Economies of scope can be represented graphically by plotting a production possibility frontier. Where the economies of scope exist, the production possibility frontier is bowed out i.e. it is concave. This curve is also called product transformation curve.

Sources of Economies of Scope

Co-Products

Economies of scope can arise from co-production relationships between final products. In economic terms these goods are called complements in production. This occurs when the production of one good automatically produces another good as a byproduct or a kind of side-effect of the production process. Sometimes one product might be a byproduct of another, but have value for use by the producer or for sale. Finding a productive use or market for the co-products can reduce both waste and costs and increase revenues.

For instance, if you own a business that makes custom shirts, you could use excess fabric left over from your production processes to make headbands or handkerchiefs.

Complementary Production Processes

Economies of scope can also result from the direct interaction of two or more production processes.

Companion planting in agriculture is a classic example here, such as the Three Sisters crops historically cultivated by Native Americans. By planting corn, pole beans, and ground trailing squash together, the Three Sisters method actually increases the yield of each crop, while also improving the soil. The tall corn stalks provide a structure for the bean vines to climb up; the beans fertilize the corn and the squash by fixing nitrogen in the soil; and the squash shades out weeds among the crops with its broad leaves. All three plants benefit from being produced together, so the farmer can grow more crops at lower cost.

Shared Inputs

Inputs like land, labor, and capital can be used to create multiple products or revenue streams, reducing operating costs. For instance, if you own or lease a warehouse to store your products, you could rent or sublease a portion of it to store goods for another business. Because productive inputs (i.e. land, labor, and capital) usually have more than one use, economies of scope can often come from common inputs to the production of two or more different goods.

For example, a restaurant can produce both chicken fingers and French fries at a lower average expense than what it would cost two separate firms to produce each of the goods separately. This is because chicken fingers and french fries can share use of the same cold storage, fryers, and cooks during production.

Proctor & Gamble is an excellent example of a company that efficiently realizes economies of scope from common inputs since it produces hundreds of hygiene-related products from razors to toothpaste. The company can afford to hire expensive graphic designers and marketing experts who can use their skills across all of the company’s product lines, adding value to each one. If these team members are salaried, each additional product they work on increases the company’s economies of scope, because of the average cost per unit decreases.

Mergers And Acquisitions

Economies of scope exist when companies make horizontal acquisitions of companies producing similar or complementary products. Because they use similar raw materials and production process, two separate firms joined by a merger can reduce costs on products made using the same assembly lines, rather than produced separately. Efficiency is gained through related diversification. Products that share the same inputs or that have complementary productive processes offer great opportunities for economies of scope through diversification.

Two regional retail chains, for example, may merge with each other to combine different product lines and reduce average warehouse costs. Goods that can share common inputs like this are very suitable for generating economies of scope through horizontal acquisitions.