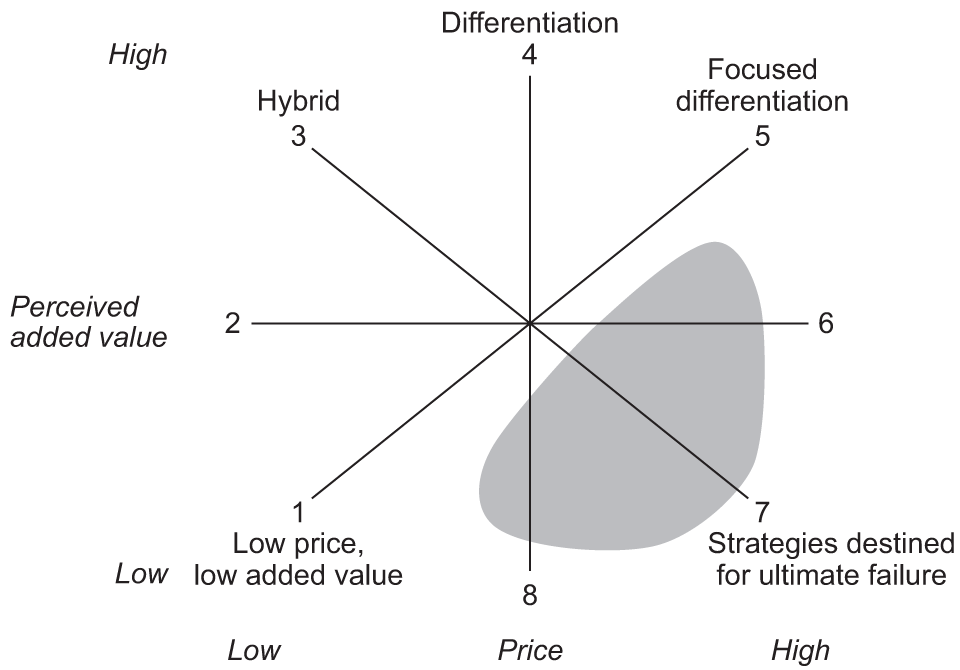

Porters Generic Strategies have been the subject of considerable critique since their introduction in 1985. Cliff Bowman and David Faulkner offered a notable expansion in 1996.Based on Bowman’s Strategy Clock, a business can choose a strategic position from that offers the greatest competitive advantage. They expanded Porters three strategic positions to eight identifiable positions, by focusing on the value proposition to customers. They created a diagram know as the Bowman’s Strategic Clock. Bowman’s Strategic Clock explores strategic positioning options. It demonstrates the range of options through which a business, company or brand can position a product based on two dimensions – price and perceived value. This leads to 8 strategic options categorized in four quadrants and demonstrated in a clock.

To evaluate and analyze the its present strategy, a company must first understand these basic strategic positions. With this understanding, a company can pursue the changes to improve its competitiveness in the market. Commencing at the top and spinning clockwise, this marketing model has the following positions:

- Low Price and Low Value Added

- Low Price

- Hybrid (Moderate Price/Moderate Differentiation)

- Differentiation

- Focused Differentiation

- Risky High Margins

- Monopoly Pricing

- Loss of Market Share

Position 1: Low Price and Low Value Added

Dollar Tree sells the majority of items for US $ 1.00 or less. It’s a great place to buy party supplies, such as decorative goods, gift bags, wraps, paper plates, cups, etc. After the party, you would prefer to throw them anyway.In this strategy position, keeping the price relatively low is the only means of the competitive method that the company can use to compete in the market. The price of the product or service offerings is very low. In addition, the product or service is not distinguished and the customer perceives very little value. Products are of inferior quality. However, prices are attractive enough to motivate customers to occasionally try them. Companies rely on volume sales to sustain their business.

This strategy is bargain basement – keeping the price low to remain competitive in the market and wish that no competitor will undercut you. This position is not very competitive within the Bowman’s Strategic Clock. Despite a low price, the product or service lacks differentiation, and the consumer perceives little value.

Position 2: Low Price

JetBlue successfully expanded its business thanks to this strategy. By 2004, SouthWest airlines offered the lowest airline fares. JetBlue offered still lower airline fares, giving it the leverage it needed over other airlines.Companies following this strategy often produce large quantities of products. In contrast to the previous strategy, the market values companies’ products. Companies sells their products at a low price, leading to the low-profit margins on the individual products. However, due to the high output volume, companies can still generate huge profits.

This position favors cheaper market leaders that have an emphasis on cost minimization, fast and low-priced production and employing economies of scale. Due to commoditization, companies engage in price wars to retain their market share.

Position 3: Hybrid (Moderate Price/Moderate Differentiation)

Ikea has built great brand loyalty by offering higher perceived value at reasonable prices. Likewise, Lush cosmetics differentiates itself through ethically made products at reasonable prices. Its commitment to social and corporate responsibilities give them a competitive edge over their rivals.This strategy is very effective if the company can clearly articulate the added value and offer its products at a consistent quality on a regular basis. This strategy combines aspects of low price and product differentiation.

A hybrid model attracts consumers by offering products at a lower / reasonable price with some product differentiation that the other brands don’t offer. Customers are convinced that the company is offering a good value product at a low price.

Position 4: Differentiation

The goal here is to provide consumers with the maximum level of perceived value.Apple is a leading brand that has implanted the differentiation strategy. Periodically, it introduces products and technologies that weren’t already available in the market. Today, owning an iPhone has become a symbol of class. They outperformed their competitors and became a pioneer in consumer electronics. By differentiating the product or service, the company is creating some unique form of value for the customer. The unique value can be similar to the value proposition of another product or service. But, some aspect of the differentiated product makes the value proposition higher.

Moreover, product quality and branding play a crucial role in this strategy. High quality products and robust brand awareness are factors that lead to high prices and added-value. As a result, customers are willing to pay more for these products as they are sensitive to the high-quality products of a renowned brand in the market.

Position 5: Focused Differentiation

Luxury brands in all industries embrace this strategy through highly targeted segmentation and distribution. For example, a Rolex watch is a luxury good. The high quality and brand image are the key differentiators. Rolex targets small market segment is willing to pay a premium for luxury watches.Focused differentiation targets to position a product or service at the utmost price levels, where buyers purchase the product or service because of the high perceived value. Their products are high priced and their target customers are willing to pay anywhere from 10 to 25 times more than their economy competitors.

The higher profit margins are attained through targeted promotions, marketing, distribution, and segmentation strategies. Their competitors are in the similar market segment and there is a tussle to keep the prices of products higher than the others.

If this strategy is done successfully, it can result in the utmost profit margins. However, only the finest brands and products can withstand the strategy in the long-term.

Position 6: Risky High Margins

As the name suggests, this is a high-risk positioning strategy. Many argue that, sooner or later, it is doomed to fail. With this strategy – without offering anything extra in regards to perceived value – the company sets high prices. If consumers continue to purchase the services or products at such high prices, the returns can be high.

Usually, this is a short-term strategy to exploit temporary market supply disequilibrium. The customer value proposition does not warrant the higher price. Some customers will continue to purchase till they identify a suitable replacement or a substitute. Over time, fewer consumers will buy the product. In a market where substitutes are not readily available, this strategy can grab a higher margin for a temporary period.

The customers will look for the better-quality product in the similar price range or a similar type of product at a lower price to cut their costs with an objective of value for money. Ultimately, they will discover a better-positioned service or product that offers more perceived value for the lower or same price. Hence, commanding a premium price without clearly articulating customer value is hard in a competitive market.

Furthermore, this strategy attracts competitors or substitute products in the market. In some scenarios, companies use this strategy to signal that a non-differentiated product is of higher quality.

Position 7: Monopoly Pricing

In the 1990s, Microsoft Windows operating system was the only viable option for personal computers. Microsoft charged software developers unreasonable prices for the patent license and information fee. Subsequently, the European union fined Microsoft US $1.3 billion citing antitrust laws.When there is a monopoly, there is just one business or company in the market offering the service or product.

A company that enjoys a monopoly position is less concerned about perceived customer value or pricing. The consumer is reliant on the company for the products it offers. As a result, monopoly pricing has consideration for customer value and the customers have limited alternatives (substitutes). In theory, the monopolist can set the price at its discretion. Customers can either buy the product or not.

Despite total market share, monopolies are difficult to achieve. Furthermore, in most economies, regulatory bodies break down monopolies to promote fair competition and increase customer value.

Position 8: Loss of Market Share

When Apple launched iPhone in 2007, it changed the customer perception of smart phones and dislodged the incumbent market leader – Blackberry. iPhone launch drew the entire consumer market towards Apple. When Google joined the fray with Android in 2008, Blackberry soon lost its perceived value and market share.The loss of market share strategy involves products with low perceived value but with disproportionately high pricing. Setting a standard or middle-range price for a service or product with low perceived value is implausible to win over many customers. This strategy generally involves taking an inferior product and pricing it to match the value proposition of superior competitor or substitute products. This strategy may be effective in short-term or trend markets. Over time, however, this tactic will alienate customers and lose market share.

This is generally the worst position to be in and suggests that the company is exiting the market or is in decline. It may be that the company has chosen this strategy to move into newer markets or the strategy may be forced upon it due to getting their price or market fit incorrect.

Bowman’s Strategy Clock is not competitive

Of the different positions in the Bowman Strategic Clock, three are not competitive. It concerns positions 6, 7 and 8, where the price is greater than the customer’s perceived value. Companies in one of these positions should either lower the price or change the product to increase customer perceived value. If this is not possible, the company should withdraw the product from the market. Nevertheless, there will always be competitors that offer a higher perceived value for a lower price.