The BCG Competitive Advantage Matrix, also known as the Advantage Matrix or Strategic Environments Matrix, is a strategic planning tool that helps companies identify and evaluate their competitive position in the market.

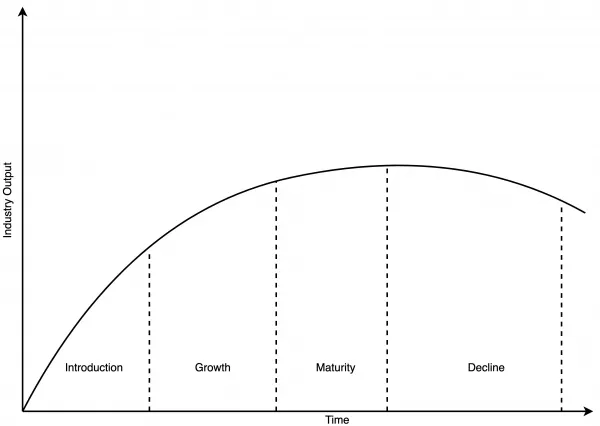

The BCG Group developed the Growth Share Matrix to achieve the economies of scale and to learn the curve economies. The Competitive Advantage Matrix helped in bringing out the assumptions behind the scale and Growth Share Matrix. It considers the industry lifecycle and the company’s competitive position.

Industry Dynamics

The Framework

BCG Advantage Matrix developed by the Boston Consulting Group (BCG) helps organizations develop strategies to gain a competitive advantage. BCG developed the Growth-Share Matrix to achieve the scale and learning curve economies. The Competitive Advantage Matrix helps surface the assumptions behind the scale and Growth-Share Matrix.

This framework is grounded in two fundamental strategic concepts:

1. Economies of scale, and

2. Differentiation

Economies of scale pertain to the cost benefits achieved through increased production volume. As a company ramps up production, the cost per unit typically decreases due to factors like bulk discounts and the spreading of fixed costs.

Differentiation focuses on developing unique product or service offerings that set them apart from competitors. This distinctiveness can be attained through avenues such as innovation, branding, or superior customer service.

Before delving into how the BCG Advantage matrix integrates these principles, let’s explore the structure of the two-dimensional matrix. The model is based on two pivotal dimensions:

- Number of approaches to gain competitive advantage: This axis reflects the variety of methods available for differentiation, spanning from product innovation to brand building

- Potential size of the competitive advantage: This axis indicates the impact any advantage can have on market share and profitability, ranging from moderate gains to industry domination.

This forms a 2×2 matrix with four distinct quadrants. The quadrants shows the type of strategy that a company should adopt for the opportunity in a particular environment.

BCG Advantage Matrix

Competitive Systems

The four types of competitive systems are:

- Stalemate

- Volume

- Specialized

- Fragmented

Stalemate Industries

In stalemate industries there is limited approaches of differentiation and small size of competitive advantage. Defined by restricted differentiation possibilities and limited advantage potential, enterprises within this quadrant confront a persistent challenge in sustaining profitability. This dynamic gives rise to intense price competition, culminating in diminished profitability, sluggish expansion, and formidable barriers to exit. Moreover, the technological knowledge is present for all competitors and the economies of scale decrease after reaching optimal size and mostly all the competitors have reached the optimal size. Therefore, the competition depends upon the prices. Finally, it results in low profitability, slow growth, high exit barriers and overcapacity.

Illustrative instances encompass commodities such as steel or cement, characterized by narrow profit margins and intense competition. Additional examples involve industries, such as textiles and ship-building, where similar market dynamics prevail.

Volume Industries

In this context, the scope for differentiation is limited, but the effects of any differentiation achieved are substantial. This implies that businesses operating at scale can leverage economies of scale to reduce production costs significantly. In other words, the volume businesses benefit from the economies of scale which would help the businesses to lower the production cost. Hence, there is an opportunity to profit from economies of scale. Consequently, there exists an opportunity to capitalize on these economies of scale for increased profitability. The pivotal factor for success lies in optimizing production volume to achieve cost reduction and secure a larger market share.

For example, in the software industry, for instance, the initial costs of development and setup may be high, but subsequent costs per unit decrease as volume increases, thanks to the advantages of economies of scale.

Fragmented Industries

In fragmented businesses the opportunity to differentiate is substantial but the impact is small. While the array of potential competitive advantage strategies is vast, the individual impact per advantage remains modest. Consequently, organizations can achieve profitability by establishing themselves as leaders in their products and services. For example, some specialty restaurants like Nandos or some local restaurant that specializes in few dishes. In such places there is less to no premium on growth.

Other examples include boutique restaurants or local craft breweries. In these cases, success hinges on the ability to provide unique offerings tailored to specific customer preferences.

Specialized Industries

Case – Apple

In 1976, Steve Jobs and Stephen Wozniak founded Apple, a company that has profoundly transformed the computer and mobile industries. Its competitive edge over rivals stems from various factors, including product offerings, customer service, and product differentiations. Apple’s emphasis on differentiation has cultivated customer loyalty, enabling them to command premium prices for their products. By targeting a specific niche segment with high-quality and unique offerings, Apple has positioned itself as a premium brand.

A pivotal strategy for Apple has been its commitment to product differentiation. This strategy not only acts as a barrier to entry for potential competitors but also mitigates the threats of new entrants and substitutes. The cost associated with achieving such product differentiation serves as a deterrent for other companies, strengthening Apple’s market position.

Examining the supplier threat, Apple’s ability to pass on increased costs to customers reduces the impact of supplier-related challenges. Furthermore, the company faces minimal threats from buyers, contributing to the viability of its product differentiation strategy.

Apple’s strategic journey aligns with the BCG Advantage Matrix. Initially competing in the Volume quadrant with personal computers, the company encountered intense competition. However, with the introduction of the iPod and later the iPhone, Apple strategically transitioned towards the Specialized quadrant.

Key elements of their strategy included:

- High Differentiation: Apple focused on designing elegant, user-friendly devices with seamless software integration, setting them apart from their less sophisticated competitors

- Premium Pricing: The differentiated nature of their products allowed Apple to command premium prices, attracting a dedicated customer base willing to pay more

- Brand Building: A robust brand identity, synonymous with innovation and exclusivity, solidified Apple’s competitive advantage

- Mastering the Specialized quadrant proved instrumental in Apple’s ascent to industry dominance, transforming from a struggling PC maker to a global technology powerhouse

The success story of Apple underscores the effectiveness of the BCG Advantage Matrix in guiding companies toward strategic excellence.

Case – Netflix

The streaming industry, as depicted in the BCG Advantage Matrix, squarely occupies the Fragmented quadrant. Here, there exists a high potential for differentiation, manifested through a diverse array of original content offerings tailored to specific niche tastes and genres. However, the impact per advantage is limited, as individual shows or genres rarely attain a monopolistic hold on the entire audience.

In this competitive landscape, Netflix employs strategic initiatives to stay at the forefront:

- Content Library Diversification: Netflix strategically diversifies its content library, ranging from acclaimed originals catering to a wide spectrum of viewer preferences

- Algorithm-Driven Personalization: The platform employs a sophisticated recommendation engine, leveraging extensive user data to keep viewers engaged by suggesting content tailored to their likely preferences

- Global Expansion: Acknowledging the fragmented nature of international markets, Netflix strategically adapts its content library and marketing to align with local preferences, facilitating global expansion

The journey of Netflix serves as a compelling illustration of adeptly navigating the competitive dynamics within the Fragmented quadrant. Through a steadfast focus on high differentiation, personalized content recommendations, and global adaptability, Netflix has established a robust position in the streaming market. However, in the face of an increasingly crowded landscape, continuous innovation and strategic evolution are imperative to sustain and reinforce their leading edge.

Impact of BCG Advantage Matrix

Risk Management

It helps in risk mitigation and management. Having knowledge about the environment of the industry you are working in would help in focusing on strategies that are compatible with the environment. It is similar to working with the strengths and sticking to it.

Project Metrics

The success metrics defined for the particular project should be properly aligned with the quadrant. For example in fragmented quadrant the focus should be on differentiation to increase the impact.

Project Speed and Duration

The speed, duration and size of the project changes with the type of environment. In a stable environment the projects speed is slow and last for a longer duration. The environment which is more adaptive the pace of change is high and duration of project is short.

Advantages

The BCG Competitive Advantage Matrix is a versatile tool that can be used to evaluate and develop strategies for businesses of all sizes and industries. It is a valuable addition to any strategic planning toolkit.

Some of the specific advantages of the BCG Competitive Advantage Matrix are:

- Simplicity: The matrix is easy to understand and use, making it a valuable tool for businesses of all sizes

- Holistic view: The matrix provides a holistic view of a company’s competitive position, considering both its strengths and weaknesses

- Actionable insights: The matrix can be used to develop a variety of actionable strategic initiatives

- Adaptability: The matrix is adaptable to a wide range of industries and markets.

Disadvantages

Some of the disadvantage of the BCG Advantage matrix are:

- Oversimplification: One of the main drawbacks of the BCG matrix is that it simplifies a complex business situation into just four categories. This oversimplification can lead to inaccurate conclusions and misguided strategies

- Static Analysis: The BCG matrix provides a static snapshot of a product’s current position, but it does not take into account the dynamic nature of the market. The BCG matrix does not provide a framework for understanding these transitions

- Ignores Synergies and Interdependencies: The BCG matrix ignores any synergies or interdependencies that may exist within organizations

- Inability to Provide Specific Strategies: The BCG matrix does not provide specific strategies or general guidelines to improve the organisation’s positioning within an industry and pivot to a more profitable category

- Limited Use in Complex Environments: The BCG matrix is most useful in relatively simple industries with stable market conditions. In more complex industries with rapidly changing market conditions, the BCG matrix may not be accurate or helpful

Despite these advantages, it’s important to note that the BCG Advantage Matrix has limitations and should be used in conjunction with other strategic tools and analyses for a comprehensive understanding of the business environment.